Ethics, Economics and Global Justice

Saturday 7th March 2009

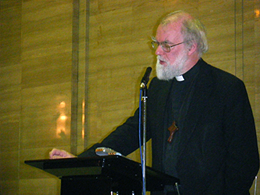

In a lecture given today in Cardiff, the Archbishop of Canterbury calls for patience and trust to be re-established in economic processes, and for governments to resist the lure of protectionism which prejudices the growth of developing economies.In response to the prevailing market turmoil and the need for a just global policy, Dr Williams urges governments, businesses and individuals to accept the importance of patience in building up the bonds of trust that have been fractured by the economic downturn:

"We need to...try to restore an acknowledgement of the role of trust as something which needs time to develop; and so also to move away from an idea of wealth or profit which imagines that they can be achieved without risk, and to return to the primitive capitalist idea of risk sharing as an essential element in the equitable securing of wealth for all"

Dr Williams argues that it is essential for ethical behaviour to be an integral part of the economic process:

"Ethics... is about negotiating conditions in which the most vulnerable are not abandoned. And we shall care about this largely to the extent to which we are conscious of our own vulnerability and limitedness."

"What is good in God's eyes for human beings not something that is altered by differences in culture or income; we can't say that what is unwelcome or evil for us is tolerable for others."

He also argues that protectionist policies conflict with our ideas of ethical behaviour, especially in relation to the markets of the developing world:

"Morally, protectionism implicitly accepts that wealth maintained at the cost of the neighbour's disadvantage or worse is a tolerable situation – which is a denial of the belief that what is good for humanity is ultimately coherent or convergent. Such a denial is a sinister thing, since it undermines the logic of assuming that what the other finds painful I should find painful too – a basic element of what we generally consider maturely or sanely ethical behaviour. Practically, protectionism is another instance of short-term vision, securing prosperity here by making prosperity impossible somewhere else; in a global context, this is inexorably a factor in ultimately shrinking potential markets."

The Archbishop also underlines the gravity of the environmental situation, and urges that this not be forgotten in the economic process:

"...environmental cost has to be factored into economic calculations as a genuine cost in opportunity, resource and durability – and thus a cost in terms of doing justice to future generations. There needs to be a robust rebuttal of any idea that environmental concerns are somehow a side issue or even a luxury in a time of economic pressure; the questions are inseparably connected.

Read a transcript of the lecture plus the questions and answers below, or click download on the right to listen [66Mb]

Ethics, Economics and Global Justice

I

In a conversation a couple of months ago at Canary Wharf, a senior manager in financial services observed that recent years had seen an erosion of the notion that certain enterprises necessarily took time to deliver and that therefore it was a mistake to look for maximal profits on the basis of a balance sheet covering only one or two years. There had been, he suggested, a deep and systemic impatience with the whole idea of taking time to arrive at a desired goal – and thus with a great deal of the understanding of both labour and the building of confidence. Either an enterprise delivered or it didn't, and the question could be answered in a brief and measurable time-span. For all the rhetoric about accountability, getting your money's worth, the effect of such assumptions in all kinds of settings has been a spectacular failure to understand the variety of ways in which responsible practice might be gauged – whether in relation to investment in actual production or in relation to new financial products, whose sustainability and reliability can only be proved after the passage of time. Very much the same kind of impatience has also been part of the tidal wave of assault on the historic professions – including the law, teaching and academic research and some aspects of public service. The short-term curse continues to afflict the voluntary sector in the absurd timescales attached to grant-giving; but all that is material for a lecture in its own right...

But in connection specifically with the financial crisis, the main point is about what appropriate patience might look like where various financial and commercial enterprises are concerned. The loss of a sense of appropriate time is a major cultural development, which necessarily changes how we think about trust and relationship. Trust is learned gradually, rather than being automatically deliverable according to a set of static conditions laid down. It involves a degree of human judgement, which in turn involves a level of awareness of one's own human character and that of others – a degree of literacy about the signals of trustworthiness; a shared culture of understanding what is said and done in a human society. And this learning entails unavoidable insecurity. I do not control others and I do not control the passage of time and the processes of nature; even the processes of human labour are limited by things outside my control (the capacities of human bodies). My lack of a definitive and authoritative or universal perspective means that I may make mistakes because I misread others or because I miscalculate the levels of uncertainty in the processes I deal in. And the further away I get from these areas of learning by trial and error, the further away I get from the inevitable risks of living in a material and limited world, the more easily can I persuade myself that I am after all in control.

Although people have spoken of greed as the source of our current problems, I suspect that it goes deeper. It is a little too easy to blame the present situation on an accumulation of individual greed, exemplified by bankers or brokers, and to lose sight of the fact that governments committed to deregulation and to the encouragement of speculation and high personal borrowing were elected repeatedly in Britain and the United States for a crucial couple of decades. Add to that the fact that warnings were not lacking of some of the risks of poor (or no) regulation, and we are left with the question of what it was that skewed the judgement of a whole society as well as of financial professionals. John Dunning, a professional analyst of the business world, wrote some six years ago about what he called the 'crisis in the moral ecology' of unregulated capitalism (in the editorial afterword to a collection of essays on Making Globalisation Good, p.357); and he and other contributors to his book discussed how 'circles of failure' could be created in the global economy by a combination of moral indifference, institutional crisis and market failure, each feeding on the others. Yet warnings went unheeded; people's rational capacities, it seems, were blunted, and unregulated global capitalism was assumed to be the natural way of doing things, based on a set of rational market processes that would deliver results in everyone's interest.

This was not just about greed. At least some apologists for the naturalness of the unregulated market pointed – quite reasonably in the circumstances – to the apparently infallible capacity of the market to free nations from poverty. It may help to turn for illumination to an unexpected source. Acquisitiveness is, in the Christian monastic tradition, associated with pride, the root of all human error and failure: pride, which is most clearly evident in the refusal to acknowledge my lack of control over my environment, my illusion that I can shape the world according to my will. And if that is correct, then the origin of economic dysfunction and injustice is pride – a pride that is manifest in the reluctance to let go of systems and projects that promise more and more secure control, and so has a bad effect on our reasoning powers. This in turn suggests that economic justice arrives only when everyone recognises some kind of shared vulnerability and limitation in a world of limits and processes (psychological as well as material) that cannot be bypassed. We are delivered or converted not simply by resolving in a vacuum to be less greedy, but by understanding what it is to live as an organism which grows and changes and thus is involved in risk. We change because our minds or mindsets are changed and steered away from certain powerful but toxic myths.

Now, you could say that ethics is essentially about how we negotiate our own and other people's vulnerabilities. The sort of behaviour we recognise as unethical is very frequently something to do with the misuse of power and the range of wrong or corrupt responses to power – with the ways in which fear or envy or admiration can skew our perception of what the situation truly demands of us. Instead of estimating what it is that we owe to truth or to reality or to God as the source of truth, we calculate what we need to do so as to acquire, retain or at best placate power (and there is of course a style of supposedly religious morality that works in just such an unethical way). But when we begin to think seriously about ethics, about how our life is to reflect truth, we do not consider what is owed to power; indeed, we consider what is owed to weakness, to powerlessness. Our ethical seriousness is tested by how we behave towards those whose goodwill or influence is of no 'use' to us. Hence the frequently repeated claim that the moral depth of a society can be assessed by how it treats its children – or, one might add, its disabled, its elderly or its terminally ill. Ethical behaviour is behaviour that respects what is at risk in the life of another and works on behalf of the other's need. To be an ethical agent is thus to be aware of human frailty, material and mental; and so, by extension, it is to be aware of your own frailty. And for a specifically Christian ethic, the duty of care for the neighbour as for oneself is bound up with the injunction to forgive as one hopes to be forgiven; basic to this whole perspective is the recognition both that I may fail or be wounded and that I may be guilty of error and damage to another.

II

It's a bit of a paradox, then, to realise that aspects of capitalism are in their origin very profoundly ethical in the sense I've just outlined. The venture capitalism of the early modern period expressed something of the sense of risk by limiting liability and sharing profit; it sought to give limited but real security in a situation of risk, and it assumed that sharing risk was a basis for sharing wealth. It acknowledged the lack of ultimate human control in a world of complex processes and unpredictable agents and attempted to 'negotiate vulnerabilities', in the terms I used a moment ago, by stressing the importance of maintaining trust and offering some protection against unlimited loss. By sharing risk between investor and venturer, it also shared power.

The problems begin to arise when the system offers such a level of protection from insecurity that risk comes to be seen as exceptional and unacceptable. We take for granted a high level of guaranteed return and so come to prefer those transactions in which the actual business of time-taking and the limits involved in material labour and scarcity of goods are less involved. It has been persuasively argued that things begin to go astray, morally, in the early and intimate association between capitalism and various colonial projects, in which abundant new natural resources and abundant new reserves of labour (notably in the shape of slavery) could be counted on to minimise some kinds of risk.

In the post-colonial climate, it has been the world of financial products that becomes the favoured basis for both personal and social economy. A badly or inadequately regulated market is one in which no-one is properly monitoring the scarcity of credit. And this absence of monitoring is especially attractive when governments depend for their electability on a steady expansion of spending power for their citizens. Increasingly, to pick up the central theme of Philip Bobbitt's magisterial works on modern global and military politics, government rests its legitimacy upon its capacity to satisfy consumer demands and maximise choices – its capacity to defer or obscure that element of the uncontrollable which in earlier phases of capitalist production dictated the habits of mutual trust and shared jeopardy, the habits that made sense of the otherwise morally controversial idea that the use of money was itself in some sense a chargeable commodity, something that needed to be paid for. Maximised choice is a form of maximised control. And it presupposes and encourages a basic model of the ideal human agent as an isolated subject confronting a range of options, each of which they are equally free to adopt for their own self-defined purposes. If an economy resting on financial services rather than material production offers more choice, a government will lean in this direction for electoral advantage, since its claim to be taken seriously is now grounded in its ability to enlarge the market in which individuals operate to purchase the raw materials for constructing their identities and projects.

As I hope will be clear, this is a deeper matter than just 'greed'. It is a fairly comprehensive picture of what sort of things human beings are; and to recognise it as a reasonably accurate model of late modern 'developed' society, especially in the North Atlantic world, is not to suggest any blanket condemnation of market principles, any nostalgia for pre-modern social sanctions and so forth – only to begin to sketch an analysis of where and how certain quite intractable problems arise. As already indicated, the modern market state, in Bobbitt's sense of the term, the state that promises maximised choice and minimal risk, is in serious danger of encouraging people to forget two fundamentals of economic reality – scarcity as an inexorable truth about a materially limited world, and concrete productivity and added value as the condition for increasing purchasing power or liberty, and thus sustaining any kind of market. The tension between these two things is, of course, at the heart of economic theory, and imbalance in economic reality arises when one or the other dominates for too long, producing an unhealthily controlled economy (scarcity-driven) or an unhealthily hyperactive and ill-regulated economy (based on the simple expansion of purchasing power).

But forget that tension and what happens is not stability but plain confusion and fantasy. We have woken up belatedly to the results of behaving as though scarcity could be indefinitely deferred: the ecological crisis makes this painfully clear. We have woken up less rapidly and definitively to the effects of displacing labour costs to undeveloped economies. The short-term benefits to local employment in these settings and in lower prices elsewhere cannot offset longer-term issues about security of employment (jobs will move when labour is cheaper in other places) and thus also the problematic social changes brought by large-scale movement towards new employment patterns that have no long-term guarantees. One effect of this pattern is the creation not of a new consumer class but of a new group of urban paupers in unstable developing economies – a phenomenon visible in some East Asian contexts.

The move away from a realistic focus on scarcity and productivity/added value and towards the virtualised economy of money transactions has been deeply seductive, and, over a limited time-frame, spectacularly successful in generating purchasing power. Given that credit is not something that is naturally 'scarce' in precisely the same sense that material resources are, inadequate regulation can, as already noted, foster the illusion that the money market is effectively risk-free; that money can generate money without constraint. In contrast to an economic model in which the exchange of goods is the basic process being analysed or managed, we have increasingly privileged and encouraged a model in which the process of exchange itself has become the raw material, the motor of profit-making. But, to repeat the point made so many times in the last few months, the problem comes when massively inflated credit is 'called in': when the disproportion between actual, measurable material security and what is being claimed and traded on the market is so great that confidence in the institutions involved collapses. The search for impregnable security, independent of the limits of material resource, available labour and the time-consuming securing of trust by working at relationships of transparency and mutual responsibility, has led us to the most radical insecurity imaginable.

III

This is not the only paradox. In a recent essay in Prospect, Robert Skidelsky discusses why it is that a globalised economy has produced a resurgence of protectionism and nationalism, not to mention the political and economic domination of a single state, the USA. We have, he suggests, been seduced into thinking that the mere lack of frontiers in global technology means that we accept a common destiny with other societies and are firmly set on the path to integrated economic operations. 'Globalisation – the integration of markets in goods, services, capital and labour – must be good because it has raised millions out of poverty in poorer countries faster than would otherwise have been possible' (p.39). But the Whiggish idea that all this represents an irreversible movement towards an undifferentiated global culture and that a world without economic frontiers is natural, inevitable and by definition benign, rests on several very doubtful assumptions, rooted in an era that is passing – an era in which it was taken for granted that we began from a position of grave scarcity and moved towards unimpeded growth. But we are now in a position of 'partial abundance' (i.e. a generally higher standard of living globally) which at the same time is more conscious of the limits of our material and environmental resources. As a result, globalisation is less obviously good news for the 'developed' world. 'The economic benefits of offshoring are far from evident for richer states', says Skidelsky (ibid.): jobs drain away to places where labour costs are cheaper, and we end up paying more to foreign investors than we earn in international markets. And the temptation for such wealthier economies is thus towards protectionism, with all its damaging consequences for a world economy. It is one of the most effective ways to freeze developing economies in a state of perpetual disadvantage; it makes it impossible for poorer economies to trade their way to wealth, as the rhetoric of the global market suggests they should.

Skidelsky argues that we need to take steps to reduce the attractions of relocating and 'offshoring' in the first place, so that countries can focus afresh on their own processes of production so as to keep both internal and external investment alive. As he says, the present situation favours economic agreements that give little or no leverage to workers and that have minimal reference to social, environmental or even local legal concerns. Learning how to use governmental antitrust legislation to break up the virtually monopolistic powers of large multinationals that have become cuckoos in the nest of a national economy would also be an essential part of a strategy designed to stop the slide from opportunistic outsourcing towards protectionism and monitoring or policing the chaotic flow of capital across boundaries.

We have yet to see how much of this is deliverable, but the thrust of the argument is hard to resist, either morally or practically. Morally, protectionism implicitly accepts that wealth maintained at the cost of the neighbour's disadvantage or worse is a tolerable situation – which is a denial of the belief that what is good for humanity is ultimately coherent or convergent. Such a denial is a sinister thing, since it undermines the logic of assuming that what the other finds painful I should find painful too – a basic element of what we generally consider maturely or sanely ethical behaviour. Practically, protectionism is another instance of short-term vision, securing prosperity here by making prosperity impossible somewhere else; in a global context, this is inexorably a factor in ultimately shrinking potential markets.

And the wider agenda sketched by Skidelsky means also that commercial concerns would be prevented from overturning the social and political priorities of elected governments. The arguments around unrepayable international debt a decade ago repeatedly underlined the destructive effects of imposed regimes of financial stabilisation that derailed governmental programmes in poor countries and effectively confiscated any means of shaping a local economy to local needs. And we hardly need reminding of the distorting effect on a national economy – and public ethics too - of being seen as a pool of cheap labour and a haven for irresponsible practices.

Several writers have said that a reformed and revitalised WTO ought to be able to move us further towards the monitoring I mentioned a moment ago. Some would be more specific and argue that for this to work effectively, there needs also to be some regulation of capital flow and exchange mechanisms, and this is where a variety of commentators from very diverse backgrounds see the 'Tobin tax' proposals as having a place taxing currency exchanges in ways that would serve national economies. We should also need some mechanisms by which it could be guaranteed that a recognisable proportion of 'savings', locally generated profits in a national economy, could be ploughed back into investment in local infrastructure, so that we should not constantly have to deal with the consequences of new money in a growing economy roaming around looking for a home and ending up fuelling the pressure on banks to lend above their capacity so as to keep the money moving.

Most such moves would, of course, require a formidable, perhaps unattainable level of global agreement and global enforceability; short of this, they could be counterproductive. But the debate on what kinds of international convergence are possible and necessary is a crucial one. The basic question that Skidelsky and others are posing, however, is how the market as we know it can be restructured so as to make it do what it is supposed to do – i.e. to offer producers the chance of a fair and competitive context in which to trade what they produce and become in turn effective investors and developers of the potential of their business and their society. The last few months have seen an extraordinary and quite unpredictable shift in the balance, with international financial transactions losing credibility and national governments coming into their own as guarantors of some level of stability. It is a rather ironic mutation of the idea of the market state: when it comes to the (credit) crunch, populations want governments to secure their basic spending power, even if it limits their absolute consumer freedoms. There is also a point, recently underlined in the debate in the Church of England's General Synod on this subject, about securing justice for future generations: any morally and practically credible policy should be looking to guarantee that future generations do not inherit liabilities that will cripple the provision of basic social care, for example. Unregulated 'freedom' in the climate of destructive speculation is not the most attractive prospect, certainly not compared with a guarantee that assets will not be allowed to drop indefinitely in value. The only way of 'maximising choice' is to make sure that it is still possible to choose and to use something, and to secure the possibilities reasonable choice for our children and grandchildren, even at the price of restricting some options. Without that restriction, nothing is solid: we should face a world in which everything flows, melts, dissolves, in a world of constantly shifting and spectral valuations.

IV

If we try to draw some of this together into a few governing principles, what might emerge? The non-economist is bound to be intimidated by the complexity of what we confront, but, as has been said, 'we are all economists now'; the specialists are not more conspicuously successful than others in mapping the territory, and this at least encourages some tentative proposals from the sidelines, however broad and aspirational. Certainly, over the last century and a half, Anglican theologians have from time to time taken their courage in their hands and attempted to outline what an ethically responsible economy might look like, and I am conscious of standing in the shadow of some very substantial commentators indeed, from F.D.Maurice to William Temple. In the background too is the formidable legacy of Roman Catholic social teaching, expressed in some powerful statements from the British and American Bishops' Conferences in recent decades. So with this heritage in mind, I shall suggest five elements, in descending order of significance, that might provide the bare bones of an economic culture capable of delivering something like an ethically defensible global policy.

(i) Most fundamentally: we need to move away from a model of economics which simply assumes that it is essentially about the mechanics of generating money, and try to restore an acknowledgement of the role of trust as something which needs time to develop; and so also to move away from an idea of wealth or profit which imagines that they can be achieved without risk, and to return to the primitive capitalist idea, as sketched above, of risk-sharing as an essential element in the equitable securing of wealth for all.

(ii) As many writers, from Partha Dasgupta to Jonathon Porritt have argued, environmental cost has to be factored into economic calculations as a genuine cost in opportunity, resource and durability – and thus a cost in terms of doing justice to future generations. There needs to be a robust rebuttal of any idea that environmental concerns are somehow a side issue or even a luxury in a time of economic pressure; the questions are inseparably connected.

(iii) We need to think harder about the role – actual and potential – of democratically accountable governments in the monitoring and regulation of currency exchange and capital flow. This could involve some international conventions about wages and working conditions, and co-operation between states to try and prevent the indefinite growth of what we might call – on the analogy of tax havens – cheap labour havens. Likewise it might mean considering the kind of capital controls that prevent a situation where it is advantageous to allow indefinitely large sums of capital out of a country.

(iv) The existing international instruments – the IMF and World Bank, the WTO and the G8 and G20 countries – need to be reconceived as both monitors of the global flow of capital and agencies to stimulate local enterprise and provide some safety nets as long as the global playing field is so far from being level. They need to provide some protective sanctions for the disadvantaged – not aimed at undermining market mechanisms but at letting them work as they should, working to allow countries to trade their way out of destitution.

(v) Necessary short-term policies to kick-start an economy in crisis – such as we have seen in the UK in recent months – should be balanced by long-term consideration of the levels of material and service production that will provide an anchor of stability against the possible storms of speculative financial practice. This is not simply about 'baling out' firms under pressure but about a comprehensive look at national economies with a view to understanding what sort of production levels would act as ballast in times of crisis, and investing accordingly.

Aspirational these may be; but what I hope is not vague here is the moral orientation that lies behind all these points. Ethics, I suggested, is about negotiating conditions in which the most vulnerable are not abandoned. And we shall care about this largely to the extent to which we are conscious of our own vulnerability and limitedness. One of the things most fatal to the sustaining of an ethical perspective on any area of human life, not just economics, is the fantasy that we are not really part of a material order – that we are essentially will or craving, for which the body is a useful organ for fulfilling the purposes of the all-powerful will, rather than being the organ of our connection with the rest of the world. It's been said often enough but it bears repeating, that in some ways – so far from being a materialist culture, we are a culture that is resentful about material reality, hungry for anything and everything that distances us from the constraints of being a physical animal subject to temporal processes, to uncontrollable changes and to sheer accident.

Implied in what has just been said is a recognition of the dangers of 'growth' as an unexamined good. Growth out of poverty, growth towards a degree of intelligent control of one's circumstances, growth towards maturity of perception and sympathy – all these are manifestly good and ethically serious goals, and, as has already been suggested, there are ways of conducting our economic business that could honour and promote these. A goal of growth simply as an indefinite expansion of purchasing power is either vacuous or malign – malign to the extent that it inevitably implies the diminution of the capacity of others in a world of limited resource. Remember the significance of scarcity and vulnerability in shaping a sense of what ethical behaviour looks like.

It is true that modern production creates markets by creating new 'needs' – or more properly new expectations. Human creativity moves on and human ingenuity constantly enlarges the reach of human management of the environment. That isn't in itself an evil; but a mature perspective on this would surely note two things. One is that there is always some choice involved in what is to be developed – and thus some opportunity cost. Not everything can be produced according to the dictates of desire, and so there will still be the need to sort out priorities. Second, we cannot ignore or postpone the question of what we want enlarged management of the environment for. The reduction of pain or of frustration, the augmenting of opportunity for human welfare and joy – again, these are obviously good things. They are good because they connect with a sense of what is properly owing to human beings, a sense of human dignity. And thus if the way in which they are secured for some reduces the opportunities of others, the pursuit of them is not compatible with a serious commitment to human dignity.

All this amounts to a belief that pursuing ethical economic growth, while not systematically hostile to new demands and new markets, while indeed acknowledging the way in which new markets can and should help to secure the prosperity of new producers, necessarily means looking critically at our lifestyle. To make it specific, and to use one of the more obvious examples, it has become more and more clear that lifestyles dependent on high levels of fossil fuel consumption reduce the long-term opportunities of basic human flourishing for many people because of their environmental cost – not to mention the various political traps associated with the production and marketing of oil in some parts of the world, with the consequent risks to peace and regional stability. Growth as an infinitely-projected process of better and cheaper access to fossil fuel-related goods, including transport, would not be an impressive ethical horizon. The question which present circumstances are forcing rather harshly on our attention is how self-critical we can find it in ourselves to be about our lifestyle in the more affluent parts of the world – not in order to adopt a corporate monastic poverty but in order to arrive at a sense of the acceptable limits to growth in the context of what might be good for the human family overall and the planet itself.

The five broad principles sketched above could only be fleshed out against a background in which people recognised that talking about the need for growth made no sense except in relation to a world of complex social and political relationships and of limited material resources – a background of willingness to ask not what might be abstractly possible in terms of increasing the range of consumer goods but what might be manageable as part of a balanced global network of forces, basic needs, mutual respect and so on.

V

Basic to everything we might want to say about the financial crisis from the religious point of view is the question, 'what for?' What is growth for? For what and for whom is wealth important? If it is essential to invest in certain kinds of productive ventures, how does this relate to the broader and longer-term imperative of securing the funding of social care future by way of sustainable shared resources, accumulated wealth? And so on. But behind such questions as these is the unavoidable issue of what human beings are for; or, to put it less crudely, what the content is of ideas of human dignity and where we look for their foundation or rationale. The principles outlined a moment ago require a context not only of geopolitical and social analysis, not even of pragmatic recognitions of the limits of material resources or the opportunity costs of certain financial decisions, but of a comprehensive sense of belonging in a world – and a world that is neither self-explanatory nor self-sufficient, but is transparent to a deeper level of agency or liberty, that level that is called God by the religious traditions of humanity. In Christian belief, the world exists because of a free act of generous love by the creator. God has made a world in which, by working with the limitations of a material order declared by God to be 'very good', humans may reflect the liberty and generosity of God. And our salvation is the restoration of a broken relationship with this whole created order, through the death and resurrection of Jesus Christ and the establishing by the power of his Spirit a community in which mutual service and attention are the basic elements through which the human world becomes transparent to its maker.

The realising of that transparency is, for religious believers of whatever tradition, the beginning of happiness – not of a transient feeling of well-being or even euphoria, but of a settled sense of being at home, being absolved from urgent and obsessional desire, from the passion to justify your existence, from the anxieties of rivalry. And so what religious belief has to say in the context of our present crisis is, first, a call to lament the brokenness of the world and invite that change of heart which is so pivotal throughout the Jewish and Christian Scriptures; and, second, to declare without ambiguity or qualification that human value rests on God's creative love and not on possession or achievement. It is not for believers to join in the search for scapegoats, because there will always be, for the religious self, an awareness of complicity in social evil. Nor is it for believers to make light of the real suffering that goes with economic uncertainty and loss – no less real for the formerly affluent Westerner faced with redundancy than for the powerless farmer or woman worker enduring yet another change for the worse in a battered and injured African or Asian economy.

But the task is to turn people's eyes back to the vision of a human dignity that is indestructible. This is the vision that will both allow us to retain a hold on our sense of worth even when circumstances are painful or humiliating and sustain the sense of obligation to the needs of others, near at hand or strangers, so that dignity may be made manifest.

In conclusion, let me suggest three central aspects of a religious – and more specifically, Christian – contribution to the ongoing debate, which may focus some more detailed reflection:

(i) Our faith depends on the action of a God who is to be trusted; God keeps promises. There could hardly be a more central theme in Jewish and Christian Scripture, and the notion is present in slightly different form in Islam as well. Thus, to live in proper harmony with God, human beings need to be promise-keepers in all areas of their lives, not least in financial dealings.

(ii) As we have noted more than once already, the perspective of faith understands human beings as part of creation – not wholly in control, though gifted with capacities that allow real and significant powers over the environment, bound to material identity and unable to escape material need. Living in faith is living in awareness of this created and limited identity without resentment or fantasy.

(iii) Living as part of creation brings with it a sense of the common destiny and common predicament of humanity. But more specifically, the Scriptural understanding of our calling, especially as set out in the letters of St Paul, sees the ideal human community as one in which the welfare and giftedness of each and the welfare of all are inseparable. What is good in God's eyes for human beings not something that is altered by differences in culture or income; we can't say that what is unwelcome or evil for us is tolerable for others.

So: trustworthiness, realism or humility and the clear sense that we must resist polices or practices which accept the welfare of some at the expense of others – there is a back-of-an-envelope idea of where we might start in pressing for a global economic order that has some claim to be just. It can't be too often stressed that we are not talking about simply limiting damage to vulnerable societies far away: the central issues exposed by the financial crisis are everyone's business, and the risks of what some commentators (Timothy Garton Ash and Jonathon Porritt) have called a 'barbarising' of Western societies as a result of panic and social insecurity are real enough. Equally it can't be too often stressed that it is only the generosity of an ethical approach to these matters that can begin to relate material wealth to human well-being, the happiness that is spiritual and relational and based on the recognition of non-negotiable human worth. There is much to fear at the moment, but, as always, more to hope for – so long as we can turn our backs on the worlds of unreality so seductively opened up by some of our recent financial history. Patience, trust and the acceptance of a world of real limitation are all hard work; yet the only liberation that is truly worth while is the liberation to be where we are and who we are as human beings, to be anchored in the reality that is properly ours. Other less serious and less risky enterprises may appear to promise a power that exceeds our limitations – but it is at the expense of truth, and so, ultimately at the expense of human life itself. Perhaps the very heart of the current challenge is the invitation to discover a little more deeply what is involved in human freedom – not the illusory freedom of some fantasy of control.

© Rowan Williams 2009

Questions and Answers following the lecture:

Question:

You talked about various things in relation to ethics. A question I'd like to ask you which you didn't mention. Do you think the exploitation of man, by man - exploitation of men by the few is ethical? To me, you know, capitalism is based on that. That's number one. Another quick question: I'd liked the phrase at the end, in your conclusion, about how we should recognise a common destiny of humanity, while recognising the welfare of each [inaudible]. There's an old phrase: "From each according to their ability. To each according to their needs". Is that basically what you're talking about?

Archbishop:

Thank you very much. To the first question then; obviously in the terms I was setting it out in – exploitation is unethical. The welfare of the few gained at the expense of the many cannot be ethical. And the second phrase, I believe it comes from a 19th century German writer of some kind, doesn't it? Originally? Who had probably better be nameless! But I think what that sets out is not a million miles away from what the primitive vision of the Christian Church in the New Testament sets out, which is: "The gift that is given to me is given to be given." It's not given to be hoarded. It's given so that surveying the environment I'm in; I find where that gift is needed. And I give it.

Question:

My heartfelt thanks for an excellent lecture which has been an inspiration to us all. My question, or my remark and question, relates in particular to global justice and common destiny and mutual respect that you mentioned. For the last two years some of us – a small group – have been very privileged to meet here at the Temple of Peace. And we meet especially to campaign against the military academy in St Helen, which is going to cost £12billion. We have existed with a long tradition of peace and justice and we want Wales to continue to lead the world, show to the world that we mean we want peace and justice. That is why we are now campaigning to set up an institute or an academy for peace. An academy where we can inspire the teaching of peace and justice and human rights in the schools and colleges of Wales and, make much better use of £12billion, in this credit crunch age. Dear Sir, what words of guidance and support do you have for us?

Archbishop:

It disturbs me greatly that in recent years military expenditure seems to be one of the areas that has no ceiling to it. We look back on the adventure in Iraq and, its' cost in any number of ways, seems to beggar the imagination. And one of the things that I feel proudest about in the Welsh spiritual and intellectual heritage, summed up for me above all by Welder Williams, is that sense of a real local rootedness that is at the same time, deeply internationalist. I think it's one of the most precious things in the Welsh political tradition.

And I think that to see that strengthened and revived is a wonderful horizon towards which to work at the moment, I really do. I'd add to that, I think, a sense which I often have very deeply when I'm talking to school children or younger people – that many of our prejudices and ingrained habits world-wide have to be learned. And, if the bad habits that perpetuate division and injustice have to be learned, well, why can't the good habits be learned? And I'm thinking of just two images in my mind at the moment – of very particular situations.

One is of a primary school in the Canterbury diocese a few miles away from Canterbury, and a not very prosperous East Kent village, which decided to take up as a school project and a village project eventually, the provision of basic medical care for an Indian village. A local doctor had been enthused by this, had enthused and rallied the school; the whole school around this project, and to spend a morning there listening to the children talk about that project was a tremendous lift to the spirit.

The other image I have in my mind is the experience I had not long before Christmas of going with a mixed group of religious leaders from Britain to Auschwitz. The chief Rabbi and I had invited about a dozen Muslim, Hindu, Sikh, Buddhist, Jain, Zoroastrian and Baha'i leaders to go to Auschwitz, with us and about 200 teenagers - a long day, in every way. But about two weeks later we asked some of the teenagers to come and have a sort of debriefing session with us. What had they learned from the day? And they had learned a deep passion about the risks of xenophobia, the 'scape-goating' and, one of them in particular said, that it had changed the whole sense of what he wanted to do with his, with his career. He knew now what the dangers were. So the young can be moved and stirred in this way. So God bless the project.

Question:

Thank you for a superb lecture and also for coming so dutifully back to Hythe, your comments are always valued. My question – first of all, I agree with the vast majority of what was in your lecture, but my question is somewhat critical – it's what you could call a "Slumdog Millionaire" question. It relates to your scepticism about off-shoring and trade.

The question is really, how are countries like India and China going to become more prosperous if they can't access Western - trade that Western countries generate, that labour can't contribute to off-shoring as in Mumbai to accessing Western wealth. I mean is that not one of the key ways in which those countries can become more prosperous? And can we really avoid that if those countries are going to become much more developed? And that's the question really.

Archbishop:

It's one of the toughest questions in this area, because, on one hand, as I said; a situation where a country can trade its way out of destitution is, is what we want to see. And at the moment we don't have a level playing field. That's clear.

Now, this is where the really difficult practical and ethical dilemmas come in. What we would regard as sweated labour, undertaken in intolerable conditions, is one of the drivers of a moderate level of prosperity, or, at least something better than destitution, in some countries. And I don't think one can simply change that overnight. That's why I concentrate on the need for some international conventions about wages and working conditions here. Now, how that's enforceable – I don't know. But without that you'll continue to have what I call the 'cheap labour havens'.

In the long run it undermines a proper recognition of human dignity, it undermines the possibilities of an intelligent democracy, it undermines the educational system, and therefore the short term lift out of absolute destitution that, you know, off-shoring to poor working conditions can produce, has a long term negative impact on the educational level and other aspects of that society. So, a very difficult balance there and, I don't think one can simply, say: avoid anything that has any hint about it of sweated labour without some attention to the question of how better labour conditions are going to be secured in developing countries? So, hugely complicated question – I'm glad you raised it.

Question:

Archbishop, so much of this seems to be about power, and at the moment the big countries are dictating to the rest of the world. I mean how do small countries – I suppose such as Wales – stand up to the big, powerful countries and, at the same time, with the power of multi-nationals, how do small governments stand up - how do ordinary people stand up to the multi-nationals?

Archbishop:

I touched very briefly on the question of multi-nationals. I think the phrase I used was that they are "Cuckoos in the nest" in small economies at the moment. And that's where I think one can't deal with these economic issues without some attention to the question of, 'How do you reinforce the liberty of an elected government to do what it's elected to do, so that it's not just at the mercy of international commercial interests?' And what that would look like I think hardly anybody knows at the moment. But it's not something that gets discussed enough in my mind, as a principal.

What one can do in standing up in other ways, not a great deal in terms of head-on confrontation, but a certain amount in terms of showing what alternatives are viable. Now, I've used the example in other contexts and, I think it's worth using here: Muhammad Yunus' Grameen Banks, beginning in Bangladesh, are now quite widespread and very influential form of what you might call, not exactly 'micro credit', but 'low level credit activity' that gives the capacity for small business enterprise with manageable returns - and, a rather different approach to interest. To show that something other than mega-capitalism is possible is one of the things we can do. And that's why I think even that the humblest local credit union can be part of demonstrating that there are ways of sustaining your economic liberty that don't all depend on the macro-scale.

Now, these are small things, but that's where I'd begin an answer to what I think is actually a very baffling question. But having seen something of what Yunus' Grameen Banks have achieved, and heard him speak on this subject not so long ago, in London, I do sense that it is possible to show that there are other ways. And a very interesting essay which I read not so long ago by an economist of Middle-Eastern origin, focused exactly on this; we've assumed very readily that there's just one economic story in the world - and it's about macro-capitalist enterprise. And actually it's not the only story, so, maybe there's a bit of an answer somewhere in that direction.

Question:

Well, thanks for staging this talk. One thing which is a big issue in Wales at the moment is the question of whether tuition fees, or top-up fees, should be paid by students. And where does that sum come from – most communities are certainly not prosperous and are going to need education. It would be good to hear your thoughts on that. But also as a supplementary problem for thought tonight; what do you think human life is for?

Archbishop:

On the first, I confess that the present situation is one in which probably it would have been very hard for someone like myself to have the education I've had. And, not unnaturally, I feel that as a kind of retrospectively and unjust dimension to that, what do we want to invest in the next generation? What do we want to invest in our children... our educational system? How important is it to us, corporately, to pay for the liberty of perspective - the critical edge that comes from education? Well, it sometimes seems not that important. Not that important. So, I've got a lot of questions there. But what is human life for? "We were made to know God, to love God and to enjoy him forever", says a well-known classical Christian text, and that's where I would begin. But translating that into terms that might apply to those in this audience who don't necessarily share my religious commitment, I would say: "We are made to be artists". That's - so in a very broad sense we are made to make a difference to our environment. Not to be just passive, but to make something communicable, beautiful, compelling out of where we are and who we are.

Second: we're made to be politicians. By that I don't mean we are all made designed by God to stand for parliament. That would be a somewhat depressing view of the human race and its purposes. But we are made to work creatively at our society; to make it reflect more fully that pattern of inter-dependence, interrelation – which I believe God has willed for us.

And third: we are made to be what I'd call 'contemplatives'. We're made, that is, to be capable of reflecting, digesting, absorbing the richness of reality without immediately asking, "What use is it?" Now, I think these three things suggest a fairly robust and, I would say a rather joyful picture of what humanity might be. For me they are anchored absolutely in my religious commitments but I don't think they're wholly alien to people who wouldn't necessarily share them.

Question:

Archbishop - you spoke very strongly against protections, but of the opposite thing to protections in accounting is neo-liberal economics. And with neo-liberal economics what we are faced with is unbridled, unprincipled or, let's say, what Gordon Brown says is a "light touch regulation." And we know where it's led us. So I didn't quite understand why you were so strongly against protectionism. In the epoch of neo-liberal economics, we've seen African countries impoverished, despite wealth, minimum wealth exported to the benefit of the few and multi-nationals. We've had Peter Mandelson, on our behalf trying, to screw a deal for Europe when he was commissioner, but a great deal for you against African nation countries.

That has been the epoch of neo-liberal economics and we've been happy with to campaign against the [inaudible] of liberalisation, primarily because it was driven - the power that was in the hands of these neo-liberal economists. Now we can hope for a big change, but surely it does depend on changing away from this light touch regulation and unprincipled neo-liberal economics. Do you see that we're going to be able to do that in future? I mean, I think we're fully justified so far in trying to stop the [inaudible] but it may be now we have to put a new vision of a new capitalist order and perhaps there's now is the time to do it. I'm just uncomfortable about your feeling so strongly against protectionism.

Archbishop:

Thank you. The trouble is that what protectionism means in the current climate is not protection for vulnerable economies, but trying to shore up wealthy economies against damage from foreign goods coming in. In other words; protectionism is something which, the west and the developed world, is now being drawn towards very, very strongly. And the trouble is that that simply sets in stone a set of existing international economic relationships, which do not allow, as I said earlier, poorer countries to trade their way out of poverty.

I think the deceptive thing about the last few years has been, very often, the language that we actually living in a 'free market world'. We're not – we're living in a world which systematically disadvantages poorer producers and protects wealthier producers - a world in which debt further skews the relationship. What I would like to see is; I think I put it: a kind of regulation that will allow sufficient protection to developing economies to take their time to get to the point where they can trade their way out of, out of poverty. So that's why I'm very, very wary of protectionism as something which the wealthier economies run to, to save themselves against the damage of an international financial crisis.